Business | Really big health

Who profits most from America’s baffling health-care system? (economist.com)

Who profits most from America’s baffling health-care system?

Hint: it isn’t big pharma

image: mariano pascual

Oct 8th 2023

On october 4th more than 75,000 employees of Kaiser Permanente, a large health-care chain, began a three-day strike. The walkout was the biggest in the history of America’s health sector, and called attention to the staffing shortages plaguing the country’s hospitals and clinics. In the same week ten drugmakers said they would negotiate medicine prices with Medicare, the public health-care system for the elderly, following legislation which all but forced them to. It will be the first time that companies have haggled over prices with the government.

Listen to this story.

Enjoy more audio and podcasts on iOS or Android.

These events are symptoms of deeper malaise in America’s dysfunctional health-care system. The country spends about $4.3trn a year on keeping citizens in good nick. That is equivalent to 17% of gdp, twice as much as the average in other rich economies. And yet American adults live shorter lives and American infants die more often than in similarly affluent places. Pharmaceutical firms and hospitals attract much of the public ire for the inflated costs. Much less attention is paid to a small number of middlemen who extract far bigger rents from the system’s complexity.

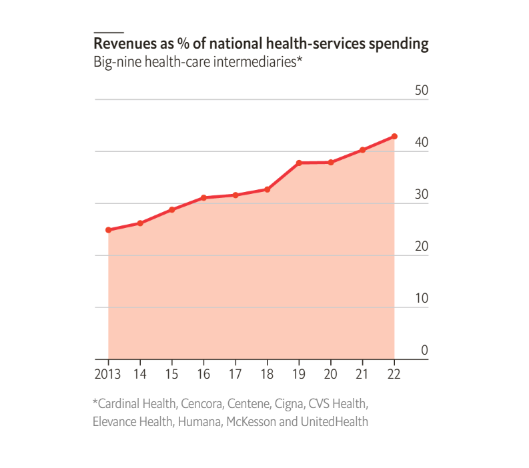

Over the past decade these firms have quietly increased their presence in America’s vast health-care industry (see chart ). They do not make drugs and have not, until recently, treated patients. They are the intermediaries—insurers, chemists, drug distributors and pharmacy-benefit managers (pbms)—sitting between patients and their treatments. In 2022 the combined revenue of the nine biggest middlemen—call them big health—equated to nearly 45% of America’s health-care bill, up from 25% in 2013. Big health accounts for eight of the top 25 companies by revenue in the s&p 500 index of America’s leading stocks, compared with four for big tech and none for big pharma.

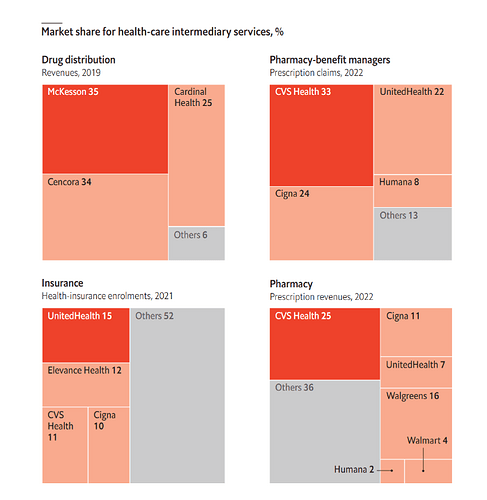

Big health began as a constellation of oligopolies. Four private health insurers account for 50% of all enrolments. The biggest, UnitedHealth Group, made $324bn in revenues last year, behind only Walmart, Amazon, Apple and ExxonMobil, and $25bn in pre-tax profit. Its 151m customers represent nearly half of all Americans. Its market capitalisation has doubled in the past five years, to $486bn, making it America’s 12th-most-valuable company. Four pharmacy giants generate 60% of America’s drug-dispensing revenues. The mightiest of them, cvs Health, alone made up a quarter of all pharmacy sales. Just three pbms handled 80% of all prescription claims. And a whopping 92% of all drugs flow through three wholesalers.

With little room left to grow in their core businesses, and trustbusters blocking attempts to buy direct rivals, the oligopolists have been expanding into other bits of the health-care supply chain. Besides adding to the top line, such vertical integration is juicing margins. The Affordable Care Act of 2010 limited the profits of health insurers to between 15% and 20% of collected premiums, depending on the size of the health plan. But it imposed no restrictions on what physicians or other intermediaries can earn. The law created an incentive for insurers to buy clinics, pharmacies and the like, and to steer customers to them rather than rival providers. The strategy channels revenue from the profit-capped insurance business to uncapped subsidiaries, which in theory could let insurers keep more of the premiums paid by patients.

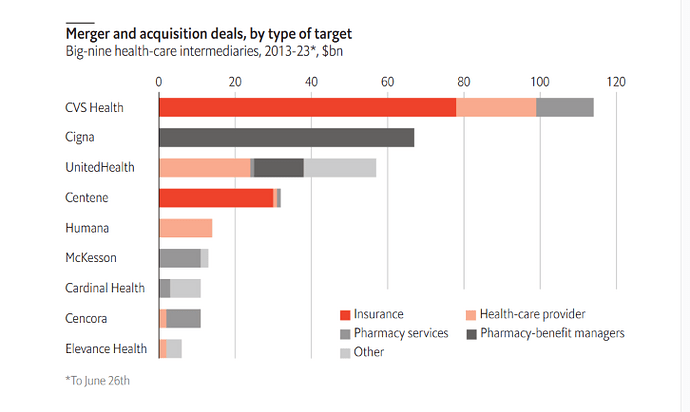

According to Irving Levin Associates, a research firm, between 2013 and August 2023 the nine health-care giants spent around $325bn on over 130 mergers and acquisitions. Some of these deals have pushed the firms deeper into each other’s turf. In 2017 cvs offered $78bn for Aetna, a large health insurer and a competitor to UnitedHealth. The following year Cigna, another big insurer, swallowed Express Scripts, a big pbm, for $67bn. In 2022 UnitedHealth paid $13bn for Change Healthcare, a data-analytics firm which processes insurance claims for large parts of the industry, including UnitedHealth’s rivals.

Both UnitedHealth and cvs have been buying up health-care providers, too. Optum Health, a subsidiary of UnitedHealth, has spent over $23bn on such transactions in the past six years, and now treats more than 20m patients through a network of 2,200 clinics. It has more doctors on its books—70,000 employed or affiliated physicians—than the biggest hospital chains in the country. cvs runs 1,100 or so neighbourhood clinics and this year alone paid $18bn for two companies focused on the lucrative elderly-care market.

Industry executives say that bringing all parts of patient care—primary-care clinics, pharmacy services, pbms and insurance—under one roof is beneficial for all. In the old fee-for-service model, big health argues, doctors or hospitals are paid for each service they provide, encouraging them to perform as many as possible and charge as much as they can. If doctors and insurance companies are part of the same business, by contrast, incentives should be aligned and overall costs should be lower.

That, at least, is the theory. And there is some truth to it. Despite its recent labour troubles, Kaiser Permanente has historically been hailed as a role model for efficient and high-quality health care. Its business, with 39 hospitals and over 24,000 doctors, is highly integrated, with Kaiser’s insurance plans covering members’ treatment at its hospitals and clinics. This April Kaiser announced it would acquire Geisinger Health, a Pennsylvania-based health system, to expand its model of integrated care to more states.

Yet vertical integration can have adverse side-effects. For example, many studies have found that after hospitals acquire physician practices, prices increase but quality of care does not. A health-care company that controls many aspects of patient care could raise prices for rivals wishing to access its network. Some also worry about physicians being nudged towards offering the cheapest treatment to patients, lowering the quality of care.

There is as yet no evidence of trouble with the model, argues Richard Frank of the Brookings Institution, a think-tank. But elsewhere in big health signs of oligopolistic behaviour can be seen. Consider pbms. These middlemen are in the crosshairs of lawmakers and regulators for their role in setting drug prices. At least four different bills that seek to regulate pbms are making their way through Congress. For almost two decades, the Federal Trade Commission (ftc), America’s main antitrust agency, pushed back against efforts to increase oversight of pbms, arguing that such moves would harm consumers. In July 2022, however, the ftc changed tack and launched an investigation into the business practices of the largest pbms.

At issue is pbms’ opaque pricing, which takes a drug’s list price and shaves off discounts that the pbm wrangles from drugmakers. pbms claim they are a counterweight to big pharma. But critics argue that large pbms do not pass on the discounts to the health plans, instead keeping much of the difference for themselves, and limit access to treatments that are less profitable for them. In August Blue Shield of California, a regional health insurer, ditched cvs’s pbm in favour of smaller firms to save on drug costs for its nearly 5m members.

America’s health-care intermediaries are indeed unusually profitable. Research by Neeraj Sood of the University of Southern California and colleagues found that intermediaries in the health-care supply chain earned annualised excess returns—defined as the difference between their return on invested capital and their weighted-average cost of capital—of 5.9 percentage points between 2013 and 2018, compared with 3.6 for the s&p 500 as a whole.

Big health’s giant pool of excess profits is at last attracting newcomers. Upstart health insurers like Bright Health Group and Oscar Health have positioned themselves as a transparent and consumer-friendly alternative to the old guard. Mark Cuban Cost Plus Drug Company, an online pharmacy started by the eponymous billionaire, bypasses the middlemen by buying cheaper generics directly from manufacturers and selling them to consumers at a fixed 15% mark-up.

Perhaps the biggest disruption to big health could come from Amazon. In 2021 its health-care ambitions suffered a setback owing to the closure of Haven Healthcare, a not-for-profit joint venture with JPMorgan Chase, the biggest bank in America, and Berkshire Hathaway, the biggest investment firm. Haven had aimed to cut health-care costs for the trio’s own staff. But despite Haven’s failure, Amazon is still expanding its health-care business. Last year it paid $3.9bn for One Medical, a primary-care provider. It runs Amazon Clinic, an online service offering virtual consultations, and RxPass, which lets members of its Prime subscription service buy unlimited generic drugs for a small fee. John Love, who heads Amazon’s pharmacy business, believes that the tech giant’s focus on customer experience, combined with its vast logistics network, makes it well-suited to shake up the industry.

So far the newcomers’ impact has been muted. Lisa Gill of JPMorgan Chase reckons that most of them underestimate the complexity of the business of health. The entrenched firms have built their networks of doctors, hospitals, insurers and drugmakers over decades. Replicating that takes time and institutional knowledge. Mr Cuban admits that it is difficult to get drugmakers to list branded drugs on his pharmacy, as they are wary of upsetting the large pbms. And without branded drugs and the support of large health insurers, his firm’s reach remains small. The cap on insurers’ profits makes life tough for upstarts in that business, which struggle to compete against the negotiating power of the integrated giants.

Even Haven, which covered its backers’ 1.2m American employees and their families, didn’t command enough market power to compel lower prices from health-care firms. Amazon’s pharmacy business has yet to break into America’s top 15 chemist chains. Big tech may be powerful. But for now even it bows before big health. ■

To stay on top of the biggest stories in business and technology, sign up to the Bottom Line, our weekly subscriber-only newsletter.

Chart sources: American Medical Association; Drug Channels; Irving Levin Associates; Refinitiv Datastream; Health Affairs; The Economist

This article appeared in the Business section of the print edition under the headline “Really big health”

Chart sources: American Medical Association; Drug Channels; Irving Levin Associates; Refinitiv Datastream; Health Affairs; The Economist

BusinessOctober 14th 2023

- Who profits most from America’s baffling health-care system?

- Why ExxonMobil is paying $60bn for Pioneer

- A $3.8bn deal points to the future of car-parts suppliers

- The fall of China’s “manganese king” may hit global EV supply chains

- Trialling the two-day workweek

- Why young consumers love Birkenstocks

- Taiwan will not surrender its semiconductor supremacy

- Weight-loss drugs are no match for the might of big food