How SMEs accessed N50bn CBN loan

![]() .

.

Beneficiaries and applications for the N50 billion businesses and households funding by the Central Bank of Nigeria (CBN), have revealed their plans on utilizing the fund.

They spoke to Daily Trust during a survey conducted to determine the impacts the fund could have in reviving business, and helping households that have struggled under the pressure brought about by the Coronavirus, COVID-19 pandemic.

Read more

CBN on March 16, 2020, announced the N50bn intervention fund to Micro, Small and Medium scale Enterprises (MSMEs) and households. It said it was to cushion the effects of the COVID-19 pandemic.

The CBN governor, Godwin Emefiele, had noted that the pandemic had trimmed revenues accruing to businesses for operation and bank loans repayment, while households who had had income cuts struggle to pay bills.

Eligible applicants extend to hoteliers, airlines services providers, healthcare merchants, among others.

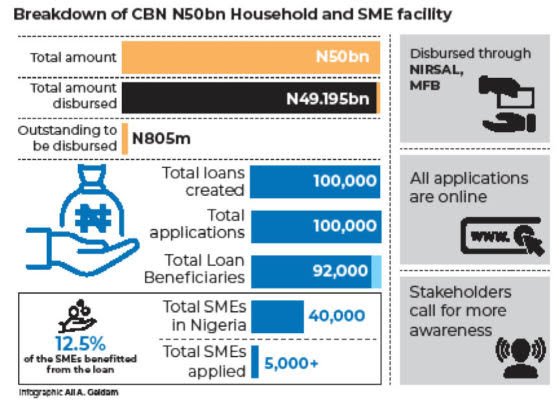

Analysis of latest CBN records on the disbursement shows that N49.195bn has been disbursed to over 92,000 beneficiaries. This paper found that while some eligible MSMEs and households have accessed the loans, some refrained from applying, fearing that the facility had been hijacked by influential persons. But NIRSAL dismissed this claim.

Initially when the facility was announced, collateral was required for SMEs and guarantors for the household loans. However, CBN waived these conditions later but some SME operators in Abuja said they did not apply because they were not fully aware of the conditions.

Others who were aware of the conditions, said they were skeptical of them, fearing that the favourable repayment plan may be changed from what was promised in the long run.

Ezekiel Bulus Michael, a trader at Deidei Building Materials Market in the Federal Capital Territory (FCT), said while picking a loan to support one’s business in “this difficult time of COVID-19” was a welcome idea, loans from banks or any financial institution “is a no go area” for him because of past issues.

However, Idris Jatau, another trader at the Kuje market, said he would try to apply for the loan. “I just started my small business, and if I can get the loan, I will collect to help my business grow. The only challenge is that I have very little information about how to access it or what I need to do to get the loan.”

Fauziya Inuwa, who operates a chicken farm in Madalla, said she would go for the loan if someone would explain to her the full details of what the loan conditions were and the risks involved.

In Ogun State, Adebayo Mansor who operates a poultry business said he applied for the loan to boost his business.

“I actually applied under the household section and I’m still waiting for their response. So, I am very hopeful,” he said.

For Mrs. Yemisi Yinusa, a fashion designer in Abeokuta, it was a blessing as she applied and got a loan. “Initially, I was skeptical about it. But I was surprised when I got the N500,000 alert last week. I have a couple of friends who have applied but are yet to receive the money.”

Zaharadeen Bello, a provision store owner in Sokoto State also got N500,000 without any challenge in accessing the fund. “I just saw it online, I used my phone to apply and I got a response that my application was successful.”

On the rate of accessing the fund by MSMEs, the National President of the National Association of Small and Medium Enterprises (NASME), Prince Degun Agboade, said the figure was very low. “My view is that those who managed to get it were so fragmented. When this fund came, we in NASME collated the names out of about 300 applications from our members in 32 states. It’s only 18 members we got information that got the loan and they slashed the money they got very heavily.”

He said most of the NASME members were not too literate to fill the complicated forms as 41 million of the 47m MSMEs were micro and not formally registered.

Agboade advocate for grants for the MSMEs instead of loans.

Commenting on the disbursement process, the immediate past president of the National Association of Microfinance Banks (NAMB), Mr. Rogers Nwoke, said the fund was good but that the implementation was faulty.

“We were excited at the announcement of N50bn palliatives initially, but we are saddened that the N50bn meant for MSMEs is going to be disbursed through only NIRSAL Microfinance Bank. That’s not practicable if we want to reach out to MSMEs; and we can see clearly the impact,” he noted.

“Even if the NIRSAL MFB has opened branches in every local government or every state, it wouldn’t have had spread in those states, it will be at best a branch in the state capital.”

Nwoke said the fund was also small considering the size of MSMEs in Nigeria. “I feel the CBN should release an additional N50bn through other MFBs to facilitate speedy disbursement to more MSME owners because this will be to existing customers of the banks,” he noted.

Responding to these issues, the Managing Director of NIRSAL MFB, Mr. Abubakar Kure, in an exclusive interview, said NIRSAL had delivered on its mandate by creating over 100,000 loans in just three months.

He said the disbursements have been done equitably. “The single requirement we are looking at is that: You must not have a failed credit outstanding in any bank, you must have a clean BVN and an identity. So based on these simple soft conditions, we were able to achieve to nearly 100,000 loans creation within three months.”

Kure also said CBN initiated a framework that ensured geographical spread. “So those regions which have shortfall now, their numbers will rise. But even the regions whose numbers are high, will still get proportionately.”

On how to recover these loans, he said, “The best thing that has happened to the banking system is the Global Standing Instruction (GSI). So if you default in your loan, we will trigger that platform and your account, wherever it is, once it has funds inside, will be debited hand and credited to NIRSAL MFB. In our offer letter, we stated it clearly.”

Kure called on more Nigerians to apply as the disbursements were ongoing.

Related

-

N50bn loan: CBN waives guarantor requirement for SMEs, households

-

Coronavirus: CBN slashes interest rates on intervention funds to 5%

Categories: Business

Tags: CBN, COVID-19, DailyTrust, loan, SMEs